UK law firms and legal teams sit on a mix of high-value assets: confidential client data, case strategy, identity documents, and (often) client money. That combination attracts phishing, ransomware, payment diversion and supplier compromise.

The tricky part: most legal regulators don’t publish a single “do these 25 controls” checklist. Instead, they set outcomes (confidentiality, governance, protecting client funds) and expect you to implement proportionate controls. Think “destination, not every turn-by-turn instruction”.

There is one place the legal sector gets much more specific: Lexcel (The Law Society’s practice management standard), which explicitly references Cyber Essentials and lists core technical controls.

Quick comparison: who says what?

Regulatory Position at a Glance

| Body | Is Cyber Essentials Required? | Prescriptive Controls? | Focus |

|---|---|---|---|

| Law Society (E&W) | Recommended | Guidance-based | Best practice + certification routes |

| SRA | Not mandated | Outcome-focused | Protect client money & confidentiality |

| Lexcel | Strongly recommended | Yes | Documented controls + governance |

| Law Society of Scotland | Recommended | Guidance-based | Risk reduction + recovery |

| Northern Ireland | Recommended | Guidance-based | Transaction fraud prevention |

| Isle of Man | No advice | Limited | General guidance |

| CLC | Strong expectation in conveyancing | Transaction controls | Fraud & payment diversion |

Common risks highlighted across the legal sector

You’ll see the same themes repeated across regulators, law societies, and national cyber bodies:

- Phishing and credential theft

- Payment diversion (especially conveyancing)

- Ransomware and operational disruption

- Business email compromise (BEC) and “CEO fraud”

- Third‑party and supply chain compromise

- Data protection incidents

The NCSC legal sector threat reporting exists because the legal sector is considered important and is actively targeted, and the intent is to improve resilience across the sector.

Common controls (what “good” looks like in practice)

Baselines

Minimum standards

You’ll see the same themes repeated across regulators, law societies, and national cyber bodies:

- Multi-factor authentication (MFA) on email, remote access, and admin accounts

- Patch management for endpoints, servers and network devices

- Modern endpoint protection (EDR/AV), plus basic hardening

- Backups (separated from the main network / immutable / tested)

- Email security (anti-phishing, DMARC/SPF/DKIM where feasible)

- Security awareness training tailored to conveyancing and finance fraud

- Access control / least privilege

- Incident response plan with roles, contacts, and reporting routes

- Payment verification procedure

Enhanced Controls

Higher Risk or Enterprise Clients

- Managed Detection and Response / SOC Services

- Conditional access (geo/device/risk-based controls)

- Central logging and monitoring (M365 audit, SIEM/SOC)

- DLP / sensitivity labelling for client data

- Supplier assurance (especially for IT and cloud vendors)

- Pen testing and vulnerability management programme

- ISO 27001-aligned ISMS where enterprise clients demand it

Where Cybersecurity Becomes Prescriptive (Lexcel & Cyber Essentials)

Most bodies point you towards good practice. Lexcel goes further by stating what a practice must have documented and operating.

- Practices must have an information management and security policy and should be accredited against Cyber Essentials.

- That policy must incorporate controls including:

- asset register

- protection/security procedures

- retention and disposal

- firewalls

- secure configuration of network devices

- user account management

- malware detection/removal

- software register

- information security training

- plan for updating/monitoring software (i.e., patching).

What is Cyber Essentials?

Cyber Essentials is described by the NCSC as the minimum standard of cyber security recommended by the UK Government, aligned to five technical controls designed to prevent the most common internet-based attacks.

What This Means for Law Firm Owners and COFAs

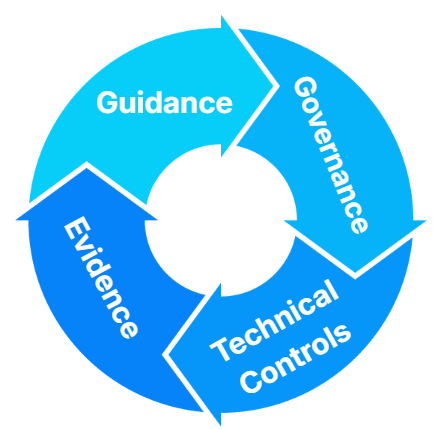

Across all regulators, three themes are clear:

- You must evidence proportionate controls.

- You must protect client money.

- You must be able to demonstrate governance.

Conveyancing and Client Money: Where the Risk Is Highest

Payment diversion fraud remains one of the most significant cyber risks facing legal practices, particularly in property transactions. Attackers frequently target email accounts involved in conveyancing chains to alter bank details or impersonate clients and estate agents.

Minimum controls for firms handling client money should include enforced multi-factor authentication on all email accounts, out-of-band verification of bank detail changes, dual authorisation for high-value transfers, and documented payment confirmation procedures. Regulators consistently focus on client money protection when assessing cyber incidents.

Turning Regulatory Guidance Into Action

Many legal practices understand what regulators expect. The challenge is turning guidance into documented policies, technical implementation, ongoing monitoring and evidence for audits.

If you are unsure whether your firm could evidence its controls in the event of a breach or audit, a structured cybersecurity review is the logical starting point. For many practices, this is delivered through a managed ITaaS model, where governance, monitoring, documentation and ongoing improvement are treated as a continuous programme rather than reactive support.

Cybersecurity in Legal Is Risk Management, Not Just IT

For legal practices, cybersecurity is a regulatory, client trust, reputational and operational issue. Technology alone doesn’t solve it. Process, documentation and governance matter just as much. That’s why legal firms increasingly move towards structured ITaaS models rather than ad-hoc support. If you want to know whether your current setup would withstand regulatory scrutiny, start with a structured review.

Frequently Asked Questions

Would Your Firm Pass Regulatory Scrutiny?

If a regulator, insurer or client asked for evidence of your cybersecurity controls tomorrow, could you provide it confidently? If the answer is uncertain, the next step is a structured cybersecurity review aligned to legal-sector expectations. Book a review or speak to our team to understand where your firm stands.