Email security is critical for financial service providers, especially Corporate Service Providers (CSPs), who handle sensitive client data and regulatory communications. One of the most effective ways to protect email domains from spoofing, phishing, and impersonation attacks is by implementing DMARC (Domain-based Message Authentication, Reporting & Conformance).

However, our recent analysis of CSPs in the Isle of Man highlights a worrying trend: nearly 50% of firms do not use DMARC, leaving them vulnerable to email fraud, impersonation, and domain abuse.

What is DMARC?

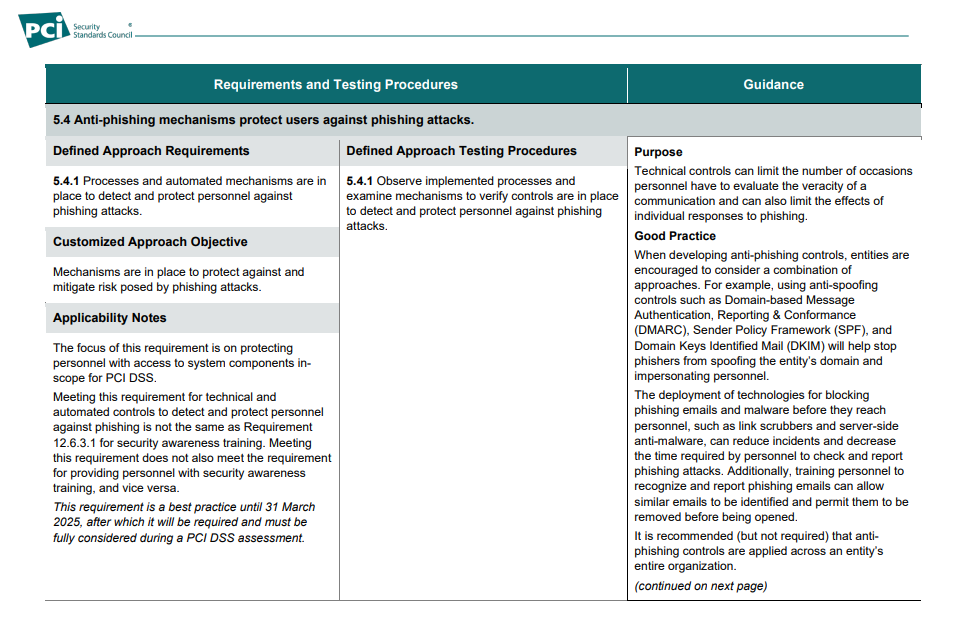

DMARC is an email authentication protocol that helps prevent malicious actors from sending emails that appear to come from your domain. By enforcing DMARC policies, businesses can:

- Prevent email spoofing and phishing attacks.

- Protect their brand reputation.

- Improve email deliverability by ensuring only legitimate emails are sent from their domain.

- Gain visibility into email traffic through detailed reporting.

You can read more about DMARC, test your own domain, and read more about DMARC on our managed DMARC service page.

Findings on DMARC Adoption Among CSPs

Our research examined e-mail domains used by CSPs in the Isle of Man and found the following:

- 50% have no DMARC records, meaning they lack protection against email impersonation attacks.

- 25% use a DIY approach, which can be complex to manage, and may not provide full security benefits.

- 25% use DMARC platform providers.

How does this compare?

According to data from a CIO Insight report, the adoption of DMARC in the financial services sector is at only 57 percent. This is broadly comparative to the Isle of Man.

The Risk of No DMARC Policy

For CSPs, the absence of a DMARC policy is a significant cybersecurity risk. Email fraud is a common attack vector in financial services, leading to:

- Business email compromise (BEC), where attackers impersonate executives to authorise fraudulent transactions.

- Phishing scams that deceive clients and employees into revealing sensitive information.

- Regulatory non-compliance, as many jurisdictions expect financial firms to take strong security measures.

- Domain spoofing and lookalike domain attacks, where fraudulent emails from the primary domain or a parked company domain trick recipients into visiting fake websites that steal credentials or financial information.

How to Implement DMARC Effectively

For financial service providers, implementing DMARC requires expertise in email authentication protocols (SPF, DKIM, and DMARC) and continuous monitoring of email traffic. A managed DMARC solution can simplify this process, ensuring:

- Correct configuration to maximise security and deliverability.

- Continuous monitoring and reporting to detect suspicious activity.

- Policy enforcement to gradually move from monitoring to full email protection.

Assess Your DMARC Score for Free

Not sure where your domain stands? Use our Free DMARC Assessment Tool to check your email security score and identify potential vulnerabilities.

Take Action: Secure Your Email Domain

If you are among the 50% of CSPs without a DMARC provider, now is the time to act. A well-implemented DMARC policy significantly reduces the risk of cyber threats targeting your domain and protects your firm, employees, and clients.

Find out how our Managed DMARC Service can help you secure your email infrastructure without the complexity of a DIY approach. Get in touch today to ensure your domain is protected from phishing and email fraud.